Trump's choice to lead Consumer Financial Protection Bureau left FDIC Monday

Published in Political News

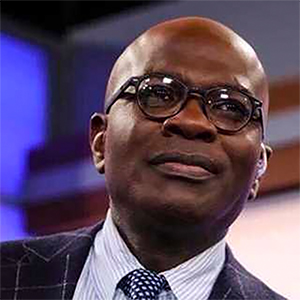

WASHINGTON — President Donald Trump nominated Jonathan McKernan to be director of the Consumer Financial Protection Bureau in an indication that he wants more than an acting head at an agency that his administration closed for this week.

Trump tapped McKernan, a former director at the Federal Deposit Insurance Corporation, for a five-year term at the helm of the CFPB. The nomination may suggest the administration is seeking to change the agency, rather than shut it down, as many Democrats suspect.

“The nomination of McKernan indicates an interest in having the agency continue to function, albeit in a much more limited capacity,” said Andrew Glass, a partner in the consumer financial services practice at the Boston office of law firm K&L Gates.

McKernan’s nomination was one of several financial regulator picks published Wednesday in the Congressional Record.

Trump also nominated Jonathan Gould, a partner at the law firm Jones Day, for a five-year term as comptroller of the currency, and Brian Quintenz, global head of policy at a16z crypto, a venture capital fund, to be chairman of the Commodity Futures Trading Commission and commissioner for a term expiring in 2029.

McKernan would take over at the CFPB from Russell Vought, the director of the Office of Management and Budget who became the CFPB’s acting director on Feb. 7. Vought immediately suspended all the agency’s work and told staff to stay home this week. He also declined the latest tranche of agency funding from the Federal Reserve.

Those actions followed a Feb. 3 directive from Treasury Secretary Scott Bessent to halt CFPB rulemaking, litigation and enforcement efforts when Bessent was the agency’s acting director.

McKernan probably won’t go as far as Vought in changing the CFPB, said a former FDIC staff member who asked not to be identified. The CFPB director is one of the members of the FDIC board. McKernan joined the FDIC board in January 2023 and announced his departure on Monday.

“Vought would want to shut down the agency,” said the former FDIC official. “Jonathan would want to really shrink it in size.”

Vought’s and Bessent’s moves to handcuff the agency drew sharp criticism from congressional Democrats, who tout the CFPB’s record of returning more than $21 billion to harmed consumers since it was established by a 2010 law that overhauled financial regulation.

In a Tuesday letter to Vought and Bessent, more than 170 House and Senate Democrats protested what they called the incursion of CFPB by staffers of the so-called Department of Government Efficiency headed by billionaire Elon Musk. They cited the CFPB’s work to stop debanking and mortgage fraud and crack down on “junk fees,” and called for it to be reopened.

“Your efforts to dismantle the CFPB are dangerous, and we will fight them at every turn,” the Democrats wrote in a letter led by House Financial Services ranking member Maxine Waters, D-Calif., and Senate Banking ranking member Elizabeth Warren, D-Mass. “We ask that you remove Mr. Musk’s operatives from the CFPB, restore all internal and external systems and operations, and allow the CFPB to continue to do its job of protecting American consumers.”

The lawmakers said the Trump administration has “effectively fired the financial cop on the beat and declared open season for predatory lenders and scam artists working to steal Americans’ money and threaten their financial security.”

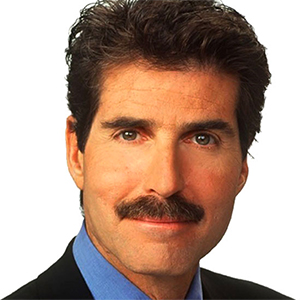

In a Tuesday Senate Banking hearing with Federal Reserve Chair Jerome Powell, Warren warned that closing the CFPB means that banks with more than $10 billion in assets, such as JPMorgan Chase and Co. and Wells Fargo and Co., aren’t being reviewed for compliance with federal laws.

“If the CFPB is not there examining these giant banks to make sure they are following the laws on cheating consumers, who is doing that job?” Warren asked Powell.

Powell responded: “I can say no other federal regulator.”

Vought and many Republicans say the CFPB has overstepped its authority.

“The CFPB has been a woke & weaponized agency against disfavored industries and individuals for a long time,” Vought wrote in a Sunday post on X, formerly Twitter. “This must end.”

House Financial Services Chairman French Hill, R-Ark., said he wanted to rein in the agency.

“It’s time to curb the power of this unaccountable agency and place the @CFPB under the Congressional appropriations process and turn it into a bipartisan commission,” Hill wrote in a post on X on Feb. 7.

McKernan is likely to face sharp questions at his Senate Banking Committee confirmation hearing about his plans for the agency. The agency is led by a single director, who would have enormous influence about enforcement and rulemaking in an administration that has so far been hostile to its work.

Congress might be able to change the CFPB’s structure but getting rid of it would be difficult.

“To close the agency would require an act of Congress,” said Greg Blase, a partner in the consumer financial services practice at K&L Gates in Boston. “It’s unclear they could get the votes in the House or Senate to do that.”

There’s quiet support among banks for the CFPB as an institution, if not for some of its more controversial rules, said the former FDIC staffer. Under the financial law known as the Dodd-Frank Act, all consumer financial protection activities were consolidated in the agency.

“The banking industry likes to have it around,” the former FDIC staffer said. “It gives it one regulator to worry about, not many. That’s why they’re so apoplectic about Vought trying to shut it down.”

©2025 CQ-Roll Call, Inc., All Rights Reserved. Visit cqrollcall.com. Distributed by Tribune Content Agency, LLC.

Comments