Stablecoins bill faces hurdle after Democrats withdraw support

Published in Political News

WASHINGTON — Senate Democratic defections from a bipartisan stablecoins bill could become a procedural hurdle as Republicans try to bring the measure to the floor, possibly as early as this week.

Four Democrats on the Senate Banking Committee who voted on March 13 to approve legislation that would facilitate issuance of stablecoins — digital currencies pegged to a reserve asset, in this case, the U.S. dollar — said over the weekend they wouldn’t vote for a revised bill released May 1. They joined five other Democrats in a statement saying the revisions hadn’t gone far enough.

Sen. Bill Hagerty, R-Tenn., the lead sponsor of the bill, called the Democrats’ change of heart a political stunt.

Supporters of the bill, along with a similar measure approved April 2 by the House Financial Services Committee, say it provides something the cryptocurrency industry has long sought: clear rules for issuing and regulating stablecoins.

The legislation would require stablecoin issuers to maintain liquid reserves comprised of safe investments such as U.S. Treasury debt, insured deposits and overnight Treasury repurchase agreements. Depending on the nature of the issuer, the regulator could be a federal or state supervisory agency.

Majority Leader John Thune, R-S.D., began the process last week of getting the bill to the Senate floor. But the Democrats who objected over the weekend said the current version “still has numerous issues that must be addressed,” including on “stronger” anti-money laundering provisions, foreign stablecoin issuers, national security concerns and enforcement.

“While we are eager to continue working with our colleagues to address these issues, we would be unable to vote for cloture should the current version of the bill come to the floor,” the May 3 statement said.

Sens. Ruben Gallego, D-Ariz., the ranking member of the Senate Banking Digital Assets Subcommittee, along with Sens. Mark Warner, D-Va.; Andy Kim, D-N.J.; and Lisa Blunt Rochester, D-Del., all of whom voted for the initial bill in committee, joined the statement.

So did two Democratic opponents of the bill in committee: Raphael Warnock, D-Ga., and Catherine Cortez Masto, D-Nev. Sens. Ben Ray Lujan, D-N.M., John Hickenlooper, D-Colo.; and Adam B. Schiff, D-Calif., who aren’t on the committee, also joined the statement.

The Democrats said they “recognize the absence of regulation leaves consumers unprotected and vulnerable to predatory practices.” They entered the negotiation process with the understanding that “additional improvements” to the bill would be made.

The revised bill added anti-money laundering and foreign stablecoin issuer provisions and stiffer penalties for violators. The Democrats didn’t elaborate on what further changes were needed to obtain their backing.

Sen. Angela Alsobrooks, D-Md., who also voted for the bill in committee, didn’t join the weekend statement. Nor did Sen. Kirsten Gillibrand, D-N.Y., an original co-sponsor of the measure.

Senate Banking ranking member Elizabeth Warren, D-Mass., has been a consistent opponent of Hagerty’s bill. She voted “no” in committee, arguing it didn’t go far enough to police the industry and prevent potential conflicts of interest.

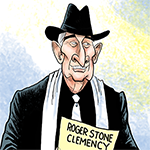

Warren and Sen. Jeff Merkley, D-Ore., on Monday said that the recently announced deal involving a United Arab Emirates-backed firm’s $2 billion investment in crypto exchange Binance, using a stablecoin issued by World Liberty Financial is reason enough to oppose the bill. President Donald Trump and his family own 60% of WLF, according to the company’s website.

‘I don’t understand’

The defection of some Democrats who had been supporters could put the bill in danger of not reaching the 60-vote threshold needed to advance legislation in the Senate.

Thune on Monday told reporters that Warren “wants to blow this up” and that she’s behind the Democrats’ opposition to the bill.

“This is the sixth version of the bill ... they’ve modified it each time based on feedback they’ve gotten, largely from Democrats,” Thune said. “I don’t understand. I’m waiting to see what they are asking for because nobody on our side seems to know. ... All the concerns that have been raised have been addressed.”

Hagerty urged the Senate to move ahead with the measure.

“We cannot allow partisan games to derail the momentum we’ve seen over the past 3 months on this legislation,” Hagerty said in a statement. “We have a choice here: move forward or underscore that digital asset and crypto legislation remains solely a Republican domain.”

The updated version of the bill was crafted to address Democratic concerns, said a Senate Republican aide with knowledge of the situation.

“Them waiting until the eleventh hour to have additional concerns after the bill was filed is disingenuous at best,” said the aide. “They were heavily consulted during the process and their priorities have already been included in the revised version of the bill.”

But the updated text didn’t satisfy Democrats’ concerns.

“We’re not playing politics with this,” said a Democratic aide familiar with the talks. “We just want good-faith negotiations.”

Return on investment?

Crypto firms and other backers spent about $140 million in last fall’s election. Their candidates prevailed in many of those races to create what the industry calls the most “pro-crypto” Congress ever.

The leaders of three digital assets trade groups — Blockchain Association CEO Kristin Smith, Crypto Council for Innovation acting CEO Ji Kim and Digital Chamber of Commerce CEO Cody Carbone — called on senators to vote for cloture in a statement they released Monday.

“A comprehensive regulatory framework will enable widespread and increased stablecoin adoption, which is essential to cementing U.S. dollar dominance in the digital economy,” the association leaders said. “We are grateful for the significant strides the GENIUS Act has already made, and we hope to see meaningful refinements to further ensure U.S. leadership in digital finance.”

They were referring to the bill’s informal name, Genius, or the Guiding and Establishing National Innovation for U.S. Stablecoins Act.

_____

(Aidan Quigley contributed to this report.)

©2025 CQ-Roll Call, Inc., All Rights Reserved. Visit cqrollcall.com. Distributed by Tribune Content Agency, LLC.

Comments