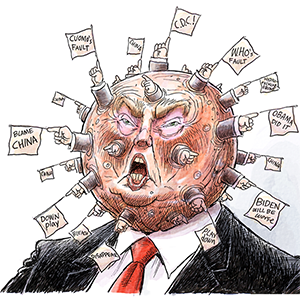

Investors are thrown by Mr. Trump's wild tariff ride. Will the president listen to the market?

Published in Political News

As a new workweek begins, here’s a reminder that businesses and investors hate uncertainty most of all.

President Donald Trump last week should have received that message clearly, as his will-he-or-won’t-he gyrations over tariffs on Canada and Mexico prompted a Wall Street sell-off. Before last week, markets were riding the Trump roller-coaster hills, falling when the president’s trade threats seemed serious and reviving when he would back off at the last minute and issue short-term reprieves. They were screaming a bit at the dips but holding on tight.

Not anymore. Last week, investors removed their arms and legs from inside the Trump car.

After insisting 25% tariffs on Canada and Mexico would go forward as planned, Trump on Thursday agreed to allow goods covered under the 2020 U.S. trade deal with the two countries — one that Trump signed — to continue to cross borders under the provisions of that agreement. For another month, anyway.

Instead of the relief rally to which Americans have grown accustomed in the early weeks of Trump’s second presidency, the Standard & Poor’s 500 index dropped 1.8% on the news. And the selling continued early on Friday despite decent news on new jobs until a modest afternoon recovery reversed the losses following Federal Reserve Chair Jerome Powell’s calm midday address at the University of Chicago’s Booth School of Business. Powell acknowledged the uncertainty of the day-to-day trade news but said the economy seems to be performing OK for now. For the week, the S&P declined 3.1%. It’s down 3.8% since Trump took office.

So what will this week bring? We’d like to say we expect Trump will have learned from the recent market reactions and curb his appetite for punishing tariffs, particularly on countries that are our neighbors and (until recently) our friends. We’ve said more than once that we view tariffs — at least those as broad as the ones Trump favors — as akin to taxes on American consumers. We live in a global economy, and while all countries protect certain industries they deem critical through various means including tariffs, a global market that’s as free as possible leads to better economic conditions in this country and most others.

David Kelly, the chief global strategist at JP Morgan Asset Management, put it well last week: “The trouble with tariffs, to be succinct, is that they raise prices, slow economic growth, cut profits, increase unemployment, worsen inequality, diminish productivity and increase global tensions. Other than that, they’re fine.”

Kelly added that he did not see that view as a partisan issue. We agree. It’s as much a Republican position (or was) as a Democratic one.

Free trade make many of the necessities of life cheaper than they otherwise would be.

Has Trump forgotten that the top issue for voters in November was the cost of living? The prospects for broad-based tariffs and resulting trade warfare not only are worrying investors, they’re making consumers anxious as well. The widely read University of Michigan survey of consumers for February found that consumer sentiment had fallen nearly 10% from just the month before and 16% from February of last year. Expectations of future price increases surged.

Worryingly for those who make and sell higher-priced goods like appliances, furniture, televisions and cars, the Michigan surveyors registered a 19% “plunge in buying conditions for durables.” Why? “In large part due to fears that tariff-induced price increases are imminent,” they said.

In other words, this whipsaw effect that seems to be a feature and not a bug of the way Trump behaves as president has the potential to harm the actual economy, which is heavily dependent on consumer spending, and not just the stock market, which arguably was overvalued before Trump took office.

An economy that by most measures was functioning smoothly pre-Trump now risks slowing or even falling into recession due in large part to psychology. In the face of such uncertainty, both consumers and businesses become more risk-averse, putting off or shelving purchases or investments that absent these doubts they’d pursue.

Their reactions are entirely rational. And the fallout is completely avoidable.

The bizarre fight Trump has picked with Canada — featuring the president’s repeated calls for a proud sovereign nation and historic ally to become the 51st state of the U.S. — has gone beyond tariffs. State-run liquor stores in multiple Canadian provinces, including Ontario, moved last week to remove American-made spirits, wine and beer from their store shelves. Lawson Whiting, CEO of the Louisville, Kentucky-based company that makes Jack Daniel’s whiskey, complained to analysts on an earnings call, “It’s literally taking your sales away. … That’s a very disproportionate response to a 25% tariff.”

Indeed it is. But that’s how trade wars go. One side acts, the other reacts, and then the original side reacts to that. They’re self-defeating, and ultimately people pay the cost at the checkout counter — and in some cases with their jobs. That’s why businesses and consumers are biting their nails right now.

Last year, the U.S. exported $763 million worth of spirits, wine and beer to Canada and imported $771 million from our neighbor to the north, according to The Washington Post. Distillers, brewers and vintners had access to both markets, could compete on a level playing field and grow their businesses based on the quality of their products. That’s as it should be.

In his address to Congress on Tuesday, Trump acknowledged that tariffs probably will cause economic pain for his fellow Americans. “There’ll be a little disturbance, but we’re OK with that,” he said. “It won’t be much.”

On Friday, speaking to the press from the Oval Office, Trump credited himself with “solving a little bit of that” by largely exempting the automobile industry from his Canadian and Mexican tariffs for a month at the request of U.S. carmakers. The auto sector, which relies more than most on free North American trade, would see costs rise substantially if tariffs were broadly imposed on auto parts and material as they move between the three countries. New cars already are unaffordable for a growing slice of American consumers. Tariffs are the last thing that industry needs.

Asked if he would adopt a firm tariff policy and stop with the “pauses and carve-outs,” Trump said, “There will always be changes and adjustments.”

That sounds like the public can expect more of this reality-show-style economic policymaking despite the market’s clear warnings. Mr. President, much of the American public isn’t “OK” with “a little disturbance,” and that includes plenty of folks who voted for you.

For the good of everyone, let’s hope the economic reality show gets canceled soon.

___

©2025 Chicago Tribune. Visit at chicagotribune.com. Distributed by Tribune Content Agency, LLC.

Comments