Are there tax implications if someone declines inheritance?

Q: My husband died without a will. We have one son and when my husband passed, my son and I signed an agreement that said if I sold any of the properties, we’d both need to agree to the sale.

When I sold one of the properties that was in my husband’s name, the settlement agent made two checks in equal amounts to me and my son. My son ended up giving me the money and didn’t keep any of it. How does this get reported to the Internal Revenue Service (IRS)? The settlement would not combine the payment to me.

A: We find it interesting that your husband owned properties only in his name and that he wanted you to get your son’s agreement before you sold any of those properties. We don’t know why. Was he overprotective? Or, was he concerned about your ability to properly manage those sales?

Once he died, we suspect that you and your son became co-owners of his properties. When someone dies without a will, you typically need to go to probate court to have things sorted out. In probate court, your state’s laws would provide for the distribution of your husband’s assets.

Most states give the surviving spouse 50%, and sometimes less, of the assets of the deceased husband. It appears that you must have inherited a half interest in the properties and your son got the other half given. That’s why the settlement agent cut a check to each of you for the same amount.

Given that your son handed over all of the cash from the sale, we assume that he wanted you to have the proceeds from the sale of this property to live on. It’s nice that he did that for you. There may be some tax consequences to his actions.

Let’s start with the value of the property. When your husband died, you and your son inherited the property at its value around the time of his death. If you sold the property within a year of his death, you’d have no profit on the sale and no federal income taxes to pay on the sale of the property. The IRS would generally say that you received and sold the property for the same amount, so there would be no tax to pay on the sale. This should be true whether the property was a personal residence or a rental property. You’ll want to confirm the details and give all of the information pertaining to the sale to your tax preparer to make sure.

Will the fact that your son signed over the check from the sale impact your taxes? From your perspective, we don’t think so. You and he sold the property for a given price and have no federal taxes to pay.

The transfer of the funds to you would either be considered a gift to you from your son or your son’s election to waive his inheritance relating to that property. If it’s considered a waiver of his inheritance for that property, you’ve received that money and there shouldn’t be any tax consequences.

On the other hand, if the IRS considers the funds he gave you as a gift, he might have to file a gift tax return with the IRS, but you might have no tax consequences from your end. He is able to give you $18,000 in 2024 without having to file a gift tax return. How much money did you each receive?

In either situation, you shouldn’t have to worry about the IRS and using those funds. The worst-case scenario is your son would need to file a gift tax return. He should talk to his tax preparer or an Enrolled Agent to get more details.

========

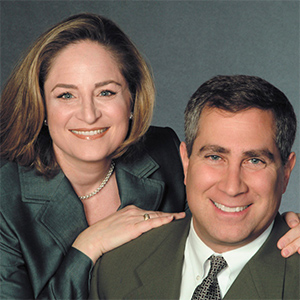

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2024 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments