The IRS home sale exclusion rule applies to primary residences only

Q: I read your column regularly and now I have a question for you.

We own two houses. One is in Chicago, which we purchased in 2010. The other is in Arizona, which we purchased in 2012. We spend the winters in Arizona and the rest of the time in Illinois.

We are getting older and it’s getting harder to maintain two homes. We’re thinking of selling the Arizona home. I called the IRS to see about the requirements to claim the $500,000 exemption on the sale of our Arizona home. The IRS said you would have to live there for 730 days out of the last five years.

We would meet this requirement. But is this information we received from the IRS correct? If it is correct, how do we prove it? Is there a form we would need to fill out or what is the process we need to follow?

We have not used the $500,000 exemption since 2010. In Arizona, we pay property taxes, pay utilities year-round, have state identification cards, a bank account, doctors, and Arizona library cards. In Illinois, we pay our federal Income taxes plus all of the information listed above for Arizona. Neither house has been rented out.

A: The way you phrased the advice that the Internal Revenue Service (IRS) gave you, one might think that you simply could live in a home for 730 days over five years to get the home sale exclusion. But, you’d be wrong.

As we’ve written before, the home sale exclusion allows a homeowner to sell their primary residence and not pay taxes to the IRS on up to $250,000 of gain (profit) from the sale of the home. If you’re married, you and your spouse can avoid paying taxes on up to $500,000 in profits. Among the most basic requirements to qualify for the home sale exclusion is that you must have lived in the home as your primary residence for two out of the last five years — hence the 730 days you were given.

You have two homes. You didn’t mention which home was your primary residence. But given that you only spend the winters in the Arizona home and the rest of the year in Illinois, we suspect that you are Illinois residents and that your Illinois home is your primary residence.

Given this scenario, you’d have to make your Arizona residence your primary home and live there for at least two years to qualify for the IRS tax exclusion on a personal residence sale. You can get quite a bit of information from the IRS website and a whole laundry list of ways to determine whether you qualify for the exclusion. The IRS site walks you through the eligibility requirements for the home with examples and steps to determine if you qualify.

If you don’t qualify for the home sale exclusion on the sale of the Arizona home, you might want to figure out what your profit would be on the sale. You’ll need to add up the purchase price, the expenses of purchasing the home, any material changes you made, and the cost of sale.

You need to have this information to make a savvy decision about selling the Arizona property.

Let’s say you purchased the home years ago for $50,000. You never put much money into it but now the home is worth $1,000,000. If you’re looking at paying that kind of capital gains tax, you might want to take up residency in Arizona for the next two years, live in the home for 730 days as your primary residence and then sell it. Then, you’ll be able to take the full advantage of the home sale excursion and avoid paying federal taxes on $500,000 in profit.

You’ll still have to pay tax on the balance of the profit, but not on the first $500,000 in profit. As an aside, for most people, the federal taxes on $500,000 in profit on the sale of a home would likely be around $120,000 plus any state and local income taxes you may have to pay.

We don’t have space to go through the math here, but consider asking a tax preparation expert or tax advisor to walk through the numbers. Finally, you can use tax preparation software to plug in the numbers to get an estimate of what the amount is that you’d owe.

========

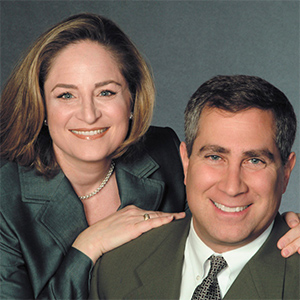

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2024 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments