How To Buy a Small Parcel From Your Neighbor

Dear Monty: We intend to negotiate a lot line adjustment with a neighbor. The size of the parcel is about 600 square feet and has been surveyed. Our neighbor is amenable to selling, but the price has yet to be determined. Our home is free and clear, but we think the neighbor has a mortgage. We live in a tiny town near a large metro area. There are city offices, but some things are handled informally. My husband estimates that an acre of land in our area is worth about $250,000, and we need about 1% of that size. The property is behind our neighbor's pool, which is walled in. It is useless to them but great as a patio for us. Any help would be appreciated.

Monty's Answer: Here are some considerations for proceeding:

No. 1: Legal and Financial Aspects: You'll need to involve the mortgage holder even for a small parcel. Their mortgage makes the land part of the collateral for the loan, and changing property lines affects this collateral. This process can be complex and requires a survey specifically for this purpose.

No. 2: Escrow Account: An escrow account is recommended. It allows a neutral third party to hold funds and documents, protecting everyone's interests.

No. 3: Agreement Components: Your agreement with your neighbor should include:

-- Precise description of the land transferred

-- Purchase price

-- Any contingencies (e.g., approval from the mortgage holder)

-- Timeline for the transaction

-- Responsibility for the costs (surveys, recording fees, etc.)

-- Any restrictions on the land

No. 4: City Involvement: Involving the city offices is crucial. Lot line adjustments often require:

-- Approval from the planning department

-- Recording of new property descriptions

-- Updating of property tax records

No. 5: Valuation: Land values vary significantly based on location, access and potential use. Consider getting a professional appraisal.

No. 6: Survey: It's excellent that you already have a survey. This survey will be crucial for your agreement's legal description and city records.

No. 7: Utility Considerations: Check for any utility lines or easements in the area you're acquiring. This could affect your ability to use the land as planned or increase the value if it provides access to utilities you currently lack.

No. 8: Future Use: Since you plan to use this as a patio, consider any zoning restrictions or building permits you might need. Even for a patio, there might be setback requirements or other regulations to consider.

No. 9: Tax Implications: Consult with a local tax professional about potential property tax changes or capital gains implications for your neighbor.

No. 10: Legal Assistance: While handling this transaction yourself is possible, given the potential complexities (especially if a mortgage is involved), consider a consult with a local real estate attorney. They can help draft the agreement and navigate any unexpected issues.

While this seems like a straightforward and mutually beneficial transaction, the key is to balance the informal nature of your small town with the need for proper documentation and legal protection. Start by confirming the mortgage situation with your neighbor, and then approach the city offices to understand their specific requirements for lot line adjustments. From there, you can determine your need for professional services.

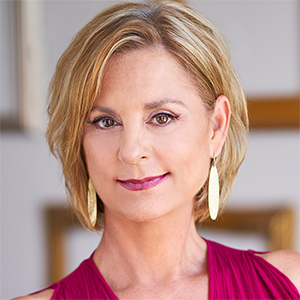

Richard Montgomery is a syndicated columnist, published author, retired real estate executive, serial entrepreneur and the founder of DearMonty.com and PropBox, Inc. He provides consumers with options to real estate issues. Follow him on Twitter (X) @dearmonty or DearMonty.com.

----

Copyright 2024 Creators Syndicate, Inc.

Comments