Joint Ownership With Family Members: A Blessing or a Curse

Dear Monty: Three siblings would like to purchase a home together. Two siblings make $30K each, and one makes $80K. Can one of the siblings qualify for government loans and the others still be on the loan? Please advise.

Monty's Answer: The short answer is yes, it's possible, depending on the specific lender and their underwriting guidelines. For example, FHA-insured loans are made by lenders and insured by the FHA, but the FHA doesn't dictate how many individuals can be on the mortgage.

From a lender's perspective, having multiple sources of repayment (in this case, three siblings) is generally preferable to relying on a single borrower. This could work in the siblings' favor during the loan application process.

There are crucial considerations beyond just securing the loan that you must address. While not explicitly asked, this advice is essential for anyone considering co-ownership, especially with family members:

Before proceeding with the mortgage, you should consider creating a formal partnership agreement. This document would outline your obligations and rights in owning the home together. The importance of this step cannot be overstated, as it provides a framework for handling various scenarios that could arise during co-ownership.

Why is a partnership agreement so crucial? Life events can significantly impact relationships and living situations, even among brothers. Some key points to address in such an agreement include:

No. 1: Financial responsibilities: Who pays the mortgage if one or two owners can't? Is this considered a loan, or does it change ownership percentages?

No. 2: Contingency plans: What happens in case of death or if an accident renders one incapable of living in the home?

No. 3: Living arrangements: Will all three live in the house? If not, how does this affect ownership and financial contributions?

No. 4: Household management: If all three live together, how will responsibilities such as chores be divided?

No. 5: Conflict resolution: How will disagreements about property management or finances be handled?

No. 6: Exit strategies: What if one wants to sell their share or move out?

These questions may seem uncomfortable or unnecessary, especially with your current good relationship. However, addressing these issues up front can prevent future misunderstandings and conflicts. It's always easier to agree on these points when everyone is on good terms rather than trying to negotiate during a crisis or disagreement. Draft this agreement with an attorney or a reputable legal website. This ensures that all necessary points are covered and the agreement is legally sound.

While it's technically feasible for the three of you to pursue a joint mortgage with one qualifying for a government loan, the more critical aspect is establishing an explicit, legally binding agreement about your co-ownership arrangement. This foresight can protect your relationships and financial interests in the long run, regardless of how your life circumstances might change.

By addressing these practical and legal considerations now you can enter into homeownership with a solid foundation, potentially avoiding many of the pitfalls that arise in shared property ownership situations.

The FHA guidelines state that multiple siblings can purchase a home together, with one sibling potentially qualifying for government loans. In contrast, the other brothers remain on the loan as co-borrowers. The loan-to-value ratio is 75% or less, based on the purchase price or the appraisal, whichever is lower.

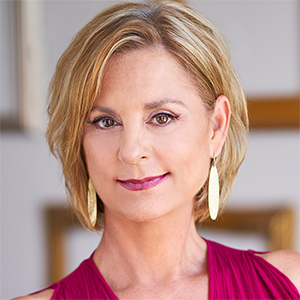

Richard Montgomery is a syndicated columnist, published author, retired real estate executive, serial entrepreneur and the founder of DearMonty.com and PropBox, Inc. He provides consumers with options to real estate issues. Follow him on Twitter (X) @dearmonty or DearMonty.com.

----

Copyright 2024 Creators Syndicate, Inc.

Comments