Mark Gongloff: California insurer of last resort went bust. It won't be alone

Published in Business News

California homeowners were just reminded that the financial backstop of last resort for houses destroyed by wildfires is … other California homeowners. It’s a sign of what’s in store for the rest of the country when too many homes lack adequate protection from the growing risk of natural disasters.

Last week, surprising no one, California’s FAIR Plan said it didn’t have enough money to cover claims from the recent Los Angeles wildfires. The plan, which insures people who can’t obtain coverage from private insurers, has doubled in size in the past four years to cover more than 450,000 homes. It faces possible exposure of $4 billion for the Palisades Fire and $775 million for the Eaton Fire but had just $700 million in cash when the fires began and a $900 million deductible on its $2.6 billion reinsurance policy. Running out of money was never a question of if for FAIR, but how quickly and by how much.

To fill the gap, California has imposed a $1 billion assessment on the state’s private insurers, all of which participate in FAIR by law. Half of that cost will pass immediately to customers, thanks to a new state rule, while the other half will just pass more slowly to customers. Many of those insurers are already dealing with heavy wildfire claims of their own. That will put even more upward pressure on premiums — State Farm has asked the state’s insurance regulator for a 22% emergency rate increase — and possibly encourage even more insurers to abandon California altogether.

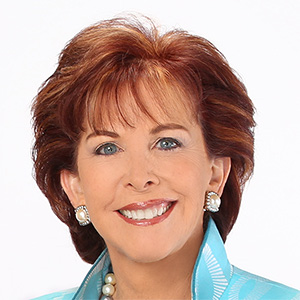

And this may not be the last time FAIR will have to go to the homeowner well this year, former California Insurance Commissioner Dave Jones told Bloomberg Green. Peak wildfire season is still months away.

This is already the largest FAIR assessment in history and the first since the 1990s. Some of the money raised then went to cover damage from 1993 wildfires in Topanga and Malibu. Both neighborhoods were heavily damaged by the Palisades Fire.

“The fact that we are once again facing this issue 30 years after wildfires devastated these same communities highlights the need for change,” current Insurance Commissioner Ricardo Lara said in a statement. “Thirty years of stagnant regulations have placed more people at risk.”

Just months ago, to reduce FAIR’s burden and lure back private insurers chased from the state by soaring wildfire losses, Lara passed new rules letting insurers use catastrophe models to set premiums. For insurers, it promised a bit of relief from Proposition 103, which has long restricted rate increases, keeping prices out of step with growing risks.

The Los Angeles wildfires basically negate any benefits of Lara’s rule tweaks. They will scare off more insurers and push even more homeowners to a FAIR plan that now has even less money. That plan already extracts relatively high premiums while offering bare-bones coverage. It will now have to charge even more for that dubious service.

This is far from just a California problem. As my Bloomberg Opinion colleague Liam Denning and I wrote recently, the whole country is struggling to adequately price and prepare for the growing risk of natural disasters as the climate grows more chaotic. Insurers frequently go bust in Florida and Louisiana, whose own last-resort providers have ballooned. Texas faces hurricanes, wildfires and the hailstorms that are also growing more destructive in Midwestern states. Flood risks are rising everywhere it rains (so: everywhere), and the thinly financed, rickety National Flood Insurance Program isn’t built to cope. The potential hit to home valuations from climate change and rising insurance premiums could be as much as $2.7 trillion, by one measure.

“The climate crisis is completely throwing insurance markets into a state of dysfunction,” Jordan Haedtler, a former House Financial Services Committee staff member and climate finance strategist working with Climate Cabinet, a nonprofit advocacy group, told me.

Haedtler tracks state insurance policies and pushes regulators to better manage climate risks. Recent years have kept these regulators busy, but not always constructively. Many reforms try to shield homeowners from harsh financial reality, like Louisiana’s recent decision to temporarily cut rates on its version of the FAIR plan, even as it tries to “depopulate” the program. And most are piecemeal, plugging leaks but failing to address rising climate risks comprehensively, Haedtler argued.

The inevitable result of a fracturing private insurance market will be the socialization of disaster losses, as seen in California, Florida and other places where FAIR plans must go begging. We could let this be messy and morally hazardous, bouncing from disaster to disaster while encouraging wealthy people to keep rebuilding mansions on wildfire- or hurricane-prone land. Or we could try to do it with foresight and fairness to limit the damage.

We can’t fix the insurance problem without also addressing land use and housing affordability, updating building-code standards and hardening our homes, communities and infrastructure against climate disasters. We should bolster the NFIP and expand its rolls, which have been shrinking even as flooding has increased. We could use that program to cover more climate risks, paired with incentives for better adaptation. And of course the sooner we stop burning fossil fuels and making the climate even warmer and more chaotic, the better.

“If you make one change and think it’s sufficient, you’re misunderstanding the scope of this problem and how serious it is, not just for the insurance industry but for our entire US financial system,” Haedtler said.

Colorado and New Mexico are two states he identified as starting to attack this issue constructively. But that’s not nearly enough, and both states’ plans are still early in the legislative stage. The climate isn’t waiting around for us to get our collective act together.

©2025 Bloomberg L.P. Visit bloomberg.com/opinion. Distributed by Tribune Content Agency, LLC.

Comments