Commentary: If countries stop buying US debt, everything changes

Published in Op Eds

For years, the financial world has taken one truth for granted: people and countries will buy U.S. debt. If that changes, everything changes.

The United States borrows 30 trillion dollars… that’s trillion with a “T.” Foreign investors are among the largest holders of U.S. government debt. Japan is the largest, based on official data, with more than $1 trillion worth of U.S. Treasury debt. China follows with $760 billion of Treasury bonds, having already reduced its holdings by more than a quarter of a trillion dollars since 2021.

This enormous amount of debt held by China, Japan, and the rest of the world, is all based on a trust in the United States of America. It is rooted in our reputation as the most pro-growth nation in the world, the fact that we are a country of the rule of law, the fact that we believe in the sanctity of contracts, and, most importantly, the belief that we can be trusted.

The entire bond market works because it is backed by the full faith of the American government. For over 60 years, it has been considered one of the safest and most stable markets in the world.

At least up until now.

If all of that changes and Japan, China, and other countries choose not to buy our debt, the impact could be seismic. This is a high-stakes game of chicken in which both sides push each other to the brink, waiting to see who backs down first. The outcome could change the global economy drastically. And that change very well might not be for the good.

This is not hyperbole!

The importance of the bond market as the bedrock of the financial system cannot be overstated, yet it is not very well understood by the public. However, it is extremely well understood by financial experts and by foreign leaders around the world.

If foreign countries were to stop buying U.S. debt, the consequences could impact the daily lives of Americans in a variety of ways.

Here are just a few of the potential ripple effects:

Higher interest rates — A decrease in demand for U.S. Treasury bonds would likely lead to a drop in their prices and an increase in yields. This would make borrowing more expensive for the U.S. government, businesses, and individuals.

Recession — Higher borrowing costs could slow down economic growth as businesses might cut back on investments and consumers might reduce spending.

High inflation — To compensate for the lack of foreign investment, the Federal Reserve might need to increase the money supply, which could lead to inflation.

Decline in the dollar's value — Reduced demand for U.S. Treasury bonds could weaken the U.S. dollar, making imports more expensive and potentially leading to a trade imbalance.

If that weren’t enough, there’s also the risk of global financial instability that could snowball into a world financial crisis. U.S. Treasury bonds are considered the safest investment. A significant shift in their demand could cause a chain reaction with catastrophic implications.

Ray Dalio, founder of Bridgewater Associates, a global investment management firm, warned last week that mounting U.S. debt problems could lead to “shocking developments.” Dailo went on to say, “The first thing is the debt issue, we have a very severe supply-demand problem,” adding this was imminent and of “paramount importance.”

He added, “Just as we are seeing political and geopolitical shifts that seem unimaginable to most people, if you just look at history, you will see these things repeating over and over again. We will be surprised by some of the developments that will seem equally shocking as those developments that we have seen.”

At the same meeting, Salesforce CEO Marc Benioff, echoed Dalio’s concerns, emphasizing that most people don’t understand the mechanics of debt but that its impact is very real and very near.

Many other financial experts expressed similar concerns last week:

— “This is not normal,” Ajay Rajadhyaksha, global chairman of research at Barclays, wrote in a report on Friday. Rajadhyaksha added, “Whatever the reason, right now, bond markets are in trouble.”

— “Wake up people," Andrew Brenner, a veteran bond trader and head of international fixed income at National Alliance Securities, wrote in a brief email. “This is foreign money existing in the treasury market due to tariff controls.”

— Jeffrey Frankel, a Harvard economist, also expressed concerns about the broader economic risks associated with debt, including its potential to exacerbate trade wars and market volatility.

— Natixis Investment Managers, which oversees over $1.4 trillion in assets, warned: “Picking fights with major trading partners who also finance your debt becomes especially risky with a wide fiscal deficit and no credible plan to rein it in."

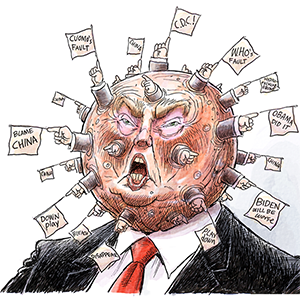

But, despite all the warnings, President Donald Trump expressed confidence in his trade policies, declaring, “Markets are going to boom." However, the very next day, after harsh responses to the tariffs by bond investors, Trump abruptly suspended his administration's "reciprocal tariffs" on dozens of other countries for 90 days, acknowledging that the bond market was "getting a little queasy."

A little queasy? That’s an understatement.

The unprecedented volatility of the markets this week — with the 30-year yield seeing its largest jump since 1982 — signals a rare level of turbulence and reflects the severity of the global economic uncertainty.

From a political standpoint, the situation is both ironic and troubling. Republicans have long championed reducing the national debt because they fear the inability of the U.S. to finance this debt. Yet, they have remained virtually silent on the potential consequences of the Trump administration's tariff policy on our ability to finance the debt. The delicate balance and the interplay between tariffs, debt, and international confidence in the financial stability of the United States is either not understood or just being ignored.

Turning a blind eye to the potentially dangerous consequences reminds me of a famous quote attributed to American writer and philosopher Ayn Rand: "You can ignore reality, but you cannot ignore the consequences of ignoring reality."

The situation is still salvageable. But the clock is ticking. The coming months will reveal whether Congress chooses to confront this reality or continue to look the other way.

_____

David Nevins is co-publisher of The Fulcrum and co-founder and board chairman of the Bridge Alliance Education Fund.

_____

©2025 The Fulcrum. Visit at thefulcrum.us. Distributed by Tribune Content Agency, LLC.

Comments