Justin Fox: How Trump can leverage an economy Americans dislike

Published in Op Eds

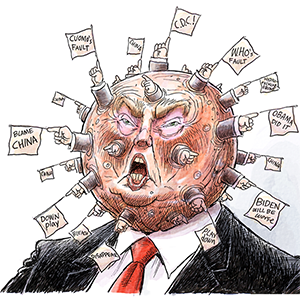

President-elect Donald Trump has spent the past few months portraying the U.S. economy as an epic disaster in need of radical action. That turns out to have been good politics. Unfortunately, it also means he’s made a bunch of bold promises to fix the economy when not meddling with a good thing is probably the best course.

Far from being a disaster, the U.S. economy is currently the envy of the world. Unemployment is low, inflation is falling, real wages are up and productivity is high and rising. That most American voters aren’t impressed can be chalked up to lingering effects of the inflation wave of 2021-2022, a frozen housing market, a recent slowdown in hiring, partisan polarization and a lamentable lack of familiarity with comparative international economic statistics.

The memory of that inflation wave will fade — Trump won’t be blamed for it in any case — and Federal Reserve rate cuts should over time help get home sales and hiring back on track. The simple passage of time will work wonders.

Another argument for less is more is that political stability and predictability are good for the economy. That’s why Wall Street usually likes partisan gridlock in Washington and why the rule of law promotes economic growth. In 2016, economists Scott Baker, Nicholas Bloom and Steven J. Davis — the latter two possibly familiar to readers for their much-cited research on the work-from-home revolution unleashed by the pandemic — devised an index that measured economic policy uncertainty based on newspaper coverage and found that:

Policy uncertainty is associated with greater stock price volatility and reduced investment and employment in policy-sensitive sectors like defense, health care, finance and infrastructure construction. At the macro level, innovations in policy uncertainty foreshadow declines in investment, output, and employment.

Since then they’ve added information on expiring tax provisions and economic forecaster disagreement to the index. It shows a sharp increase in uncertainty early in the COVID-19 pandemic, and a mostly declining trend since.

A compelling historical case for the benefits of reduced policy uncertainty can be found in Bill Clinton’s presidency, specifically the final three-quarters of it. After a failed attempt at comprehensive health-care reform and then a wave election in 1994 that put Republicans in charge of both houses of Congress for the first time in 42 years, President Clinton was forced to curtail his domestic policy ambitions — and was rewarded with an economic boom and the highest second-term approval ratings of any president on record (the record in this case starting with Harry Truman).

A key contributor to that Clinton economic boom was rising productivity enabled by Silicon Valley breakthroughs. Given recent advances in artificial intelligence, a similar boost is not out of the question in coming years.

Trump will also start out his second term with several near-automatic uncertainty reducers. The debt-ceiling brinkmanship that delivered repeated spikes in the economic policy uncertainty index in the 2010s is something that happens with a Democratic president and Republicans in charge of the House, so there’s little risk of that even if Democrats eke out a House majority. The Republican penchant for putting regulation on hold is, whatever its long-term consequences, a short-term uncertainty damper. And by electing Trump and (probably) a Republican congressional majority, voters seem to have ensured that the provisions of the Tax Cuts and Jobs Act of 2017 that were due to expire next year won’t.

The chances of Trump sitting tight are, I realize, slim to none. Presidents generally try to make good on their campaign promises, and Trump has promised mass deportations, sharp tariff increases, a grab-bag of tax cuts and an assault on Federal Reserve independence that taken together would probably slow economic growth while putting upward pressure on inflation, deficits and economic uncertainty. Trump’s election victory is already making it seem less likely that the Fed will be able to continue cutting rates.

The economic backdrop is so favorable right now that growth will probably continue despite all this meddling. I’m not predicting disaster. And I understand that, with the electorate grumpy about the economy, being seen to do something about it is important. But Trump has proved to be a uniquely adept communicator, a man who could surely convince his fans that he was taking drastic action even while doing nothing at all. And at the moment, that would be the best economic policy.

_____

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Justin Fox is a Bloomberg Opinion columnist covering business, economics and other topics involving charts. A former editorial director of the Harvard Business Review, he is author of “The Myth of the Rational Market.”

_____

©2024 Bloomberg L.P. Visit bloomberg.com/opinion. Distributed by Tribune Content Agency, LLC.

Comments