The GOP's Gigantic Opportunity

Donald Trump won the election. The House and Senate are in Republican hands. That means the GOP now owns the debt and its consequences. This responsibility, while too much for past politicians, presents the opportunity of a lifetime: namely, to be the ones who put the government back on fiscal track and, among other things, save entitlement programs from long-term disaster.

As a reminder, our debt is huge. It's the size of the annual economy and is set to reach at least 166% of GDP in 30 years. Interest rates are high and have driven interest payments on that debt to levels not seen in a long time. These payments will eat up 20% of government revenue next year. If we exclude revenue earmarked for Social Security and, hence, already committed, that number is over 27%. It grows going forward and may even explode if interest rates end up higher than projected.

This isn't just a government problem; it's a you-and-me problem. A large body of literature shows that rising debt leads to higher interest rates and slows economic growth. The indebtedness crowds out private investment, reduces the ability of businesses to expand, innovate and hire, and ultimately harms the very people policymakers aim to protect.

No matter how enticing the reason, when Uncle Sam takes larger slices of the economic pie, the portion left for productive private enterprises shrinks, resulting in a smaller, less dynamic economy and fewer opportunities.

Then there is the very real risk that our creditors demand higher interest rates in exchange for buying more treasuries, making the problem bigger. They might also worry that the Federal Reserve will devalue our debt with inflation.

As The Washington Post editorial board rightfully warned incoming Republicans, large unfunded tax cuts could "cause exactly the kind of inflation that doomed Democrats in this election cycle. Worse, (Trump) runs the risk that the bond market will finally say 'enough' and start demanding even higher interest rates to offset the risks of buying into America's ballooning debt."

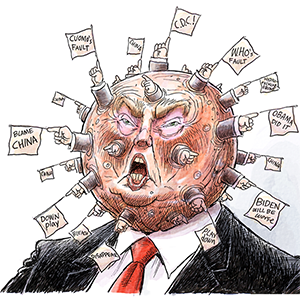

It's a sound warning considering the first Trump term wasn't fiscally responsible. Republicans on the campaign trail reminded everyone how great the Trump economy was, and how low inflation and interest rates were. But this same booming economy made the deficit and debt growth all the more unnecessary. Even before the pandemic spending explosion, the budget deficit was approaching $1 trillion.

Perhaps the second administration, with a fresh mandate, will show the discipline and leadership needed to change our fiscal trajectory.

The allure of quick fixes and big spending programs is strong. The popular, yet misguided, pitfall of the moment -- expanding the federal government's role by dumping money into pet projects and subsidizing manufacturing and new family entitlements -- all but ignores costs. Extending the Trump tax cuts and adding provisions such as no taxes on tips or overtime pay (without any offsets) will also be tempting. As will be denying that reforming Social Security and Medicare are fiscal imperatives.

Instead, Republicans should focus on slowing the growth of debt-to-GDP. Economic growth is an important factor to achieve this goal, and the Trump agenda includes some such policies. Reducing excessive red tape that stifles businesses and hampers productivity, as well as more capital-friendly tax policies, would boost economic efficiency and give companies more freedom to allocate resources effectively, boosting tax revenue. Such regulatory and fiscal relief is especially important in the manufacturing sector.

Yet economic growth alone won't pay off the debt. It played a role in helping the country shed some of its debt after the Second World War, from a 103% debt-to-GDP ratio in 1945 down to 25% by 1973. However, a recent paper showed that it is only a piece of the puzzle. The main factor in those decades' declining debt ratio was the austerity that followed the war, which produced primary surpluses (revenue minus spending, excluding interest payments on the debt).

This decline was essential and relevant to our current situation. While the inflation that plagued the United States in the 1970s and '80s was painful, it would have been much worse had the public debt-to-GDP not been relatively low. Today, with the debt at 100%, we aren't so lucky.

The road ahead will be difficult, and the choices won't be popular. But if Trump wants to be remembered as the president who helped restore America's economic health, he must shy away from debt-fueled government expansion and embrace fiscal discipline and renewed trust in the power of the market.

Veronique de Rugy is the George Gibbs Chair in Political Economy and a senior research fellow at the Mercatus Center at George Mason University. To find out more about Veronique de Rugy and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate webpage at www.creators.com.

----

Copyright 2024 Creators Syndicate, Inc.

Comments