Taking From Peter To Give to Paul Is Not America

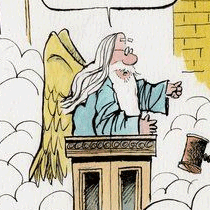

A newspaper story several years ago reported about an elementary school teacher who held elections in his class.

The students picked their candidates -- one little boy competing against one little girl.

The little boy stood up before the class and shared his ideas for changes that would improve their lives. The little girl stood up and promised that everyone who voted for her would get ice cream.

The little girl won, hands down.

Maybe it's a cute story about 10-year-olds. But it's far less cute if we consider that the political reality in our country today is not much different.

Two-thirds of federal spending, which now takes almost one-fourth of our GDP, are transfer payments.

As opposed to federal spending that involves direct payments to individuals or firms -- like salaries or purchases made by the Department of Defense -- transfer payments are payments that are automatically transferred to one set of citizens out of the federal budget, as well as funds that the federal government transfers to the states.

We're talking about programs such as Social Security, Medicare, food stamps, refundable tax credits, Medicaid, housing, welfare and transit.

These are automatic, mandatory transfers, which, as a percent of federal spending, have increased by about a factor of 5 since 1950.

Per the House Budget Committee, the percentage of the U.S. population enrolled in Medicaid has increased from 9.3% in 1975 to 24.3% in 2022, getting food stamps from 7.9% in 1975 to 12.4% in 2022, and the earned income tax credit from 2.9% in 1975 to 9.3% in 2021.

The oldest and largest of these programs is Social Security. Whenever I convey that Social Security comes under the heading of federal entitlements, I get irate letters from those getting Social Security telling me they worked to get their benefits.

But that isn't the point. The point is most Americans have no choice to be or not be in the program, and once in, everything is automatic -- when and how much is paid (although there is some latitude when to start receiving the benefit) -- and the benefits received are from taxes paid by others.

It is important to appreciate, which most don't, that these types of transfers were once considered unconstitutional. It was Social Security that changed the game.

Taking from Peter to pay Paul was never understood to be a constitutional authority of the federal government.

But after President Franklin D. Roosevelt signed Social Security into law in 1935, its constitutionality was challenged in the case known as Helvering v. Davis.

The court, in that case, found Social Security constitutional in a major expansion of understanding of the "general welfare" clause of the U.S. Constitution -- "The Congress shall have Power To lay and collect Taxes ... and provide for the common Defense and general welfare." As result of this ruling, a new understanding of "general welfare" gave Congress vast and wide new authority to tax and finance programs, even though those areas are not clearly enumerated in the Constitution as authority of the federal government.

Thus, the modern American welfare state was born, and the door was opened for politicians to promise ice cream in exchange for votes and power.

It is the main source of the explosion of federal spending, and now federal borrowing.

Change is possible. I began my career working on welfare reform.

With reform of AFDC, Aid to Families with Dependent Children, and of TANF, Temporary Assistance for Needy Families, the percentage of the population on welfare dropped from 5.2% in 1975 to 0.9% in 2019.

The founders envisioned a free nation under God in which the role of government is to protect life and property.

Our real challenge is to restore this mission and vision. It will make us all better off.

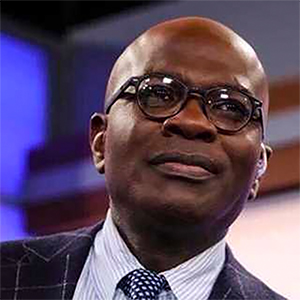

Star Parker is president of the Center for Urban Renewal and Education and host of the weekly television show "Cure America with Star Parker." Her recent book, "What Is the CURE for America?" is available now. To find out more about Star Parker and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate website at www.creators.com.

----

Copyright 2024 Creators Syndicate, Inc.

Comments