When will you receive a 1099-S for property sale?

Q: I just sold my house and moved into a 55-plus community. I paid an entrance fee to the community and now pay rent on my apartment every month.

I want to be prepared for filing my 2024 taxes. My understanding is I need a 1099-S form for my house sale. I’ve asked my real estate agent where I get this document, and he didn’t know. I did an online search and discovered that the closing agent would have the form.

Who is the closing agent? Is it the title company?

A: You’re right in that there is a form 1099-S and that a home seller might expect to receive that form upon the property’s sale. The purpose of the 1099-S form is to notify the Internal Revenue Service (IRS) of the sale. The form details the seller’s information, including social security number, sales price for the home and the date of the sale.

But the vast number of home sellers will not receive a 1099-S form when they sell their primary residence. For starters, if you sell your primary residence for less than $250,000 (or $500,000 if you are married), the settlement agent doesn’t need to report the sale to the IRS, so you won’t get a form.

Why? Current tax law. When you sell your primary residence, the IRS allows you to exclude from tax the first $250,000 (or $500,000 if you are married) of profit. Given these numbers, the 1099-S isn’t given to sellers if they certify to the settlement agent that they are selling their primary residence for less than the $250,000 (or $500,000), they used the home solely for residential purposes, lived in the home for two out of the last five years and did not take the tax exclusion on another home in the last two years.

However, if you are selling a higher priced home, used part of the home for business purposes, or are selling a home that also has a rental unit that is part of it, the settlement agent should issue you a 1099-S on the sale of the home.

Who provides the form? In states where title companies close the real estate transaction, the title company will give you the form at the time of the sale or they’ll mail you the form after the sale. In states where the settlement agent is a closing attorney, the closing attorney should issue the form. Basically, the person or entity that handles the closing and disburses the money to the seller would issue the 1099-S.

If you believe you should have been issued a form, call the title or settlement company and speak to the person who helped you close the deal.

========

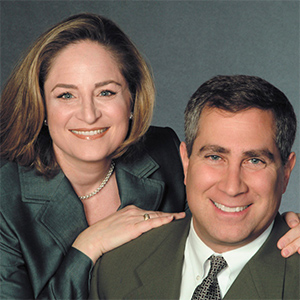

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2024 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments