As tariffs loom and global currency values fluctuate, goods from these top US trade partners may shift in price

Published in Slideshow World

Subscribe

As tariffs loom and global currency values fluctuate, goods from these top US trade partners may shift in price

Since his reelection, President Trump has followed through on campaign promises to impose tariffs on America's biggest trading partners—Canada, China, and Mexico—in an attempt to further his terms on trade, borders, and drug trafficking crackdowns. But the tariff threats, reversals, deals, and reprisals are leaving consumers, businesses, and economists experiencing whiplash about what's going to happen next.

Tariffs are import taxes on foreign goods, but it's not foreign companies who pay them. When the United States slaps a tariff on Chinese steel, American businesses that import the material pay up. Fees are collected by Customs and Border Protection agents at ports of entry, and into Treasury coffers. When tariffs rise, those companies face a choice: If they can't find domestic sources for necessary goods, they must eat the cost and watch their profits shrink, or pass the rising fee on to consumers through higher prices.

While the rationale behind Trump's approach to tariffs may be to increase revenue, balance trade, and assert dominance over rival countries, those outcomes are far from certain. Tariffs not only run the risk of raising prices, but in some cases, they also up the ante for U.S. exports by creating a game of brinkmanship. For example, when Trump enacted a 10% hike on Chinese imports in early February, Beijing swiftly responded by targeting American energy with 15% tariffs on coal and natural gas, and 10% duties on crude oil and farm equipment.

Because China exports more to the U.S. than it imports, it is limited in its ability to match Trump's tariffs one for one. So this time China has added additional measures to strike back and cause other forms of financial and business hardship. China's Ministry of Commerce also launched an antitrust probe into Google and blacklisted two American firms—fashion powerhouse PVH Group, which owns global clothing brands Tommy Hilfiger and Calvin Klein, along with biotech firm Illumina. China also restricted exports of critical minerals like tungsten and tellurium, essential ingredients for everything from smartphones to electric vehicles.

Meanwhile, Trump postponed threatened 25% tariffs on Canada and Mexico after securing border security commitments. Canada pledged $1.3 billion Canadian dollars (or $915 million USD) for border investment and appointed a new so-called fentanyl czar, while Mexico agreed to deploy 10,000 National Guard troops along its northern border in an attempt to curb drug trafficking and crime.

For consumers, the impact could soon appear in everyday purchases. Those surprisingly affordable flat-screen TVs might see price hikes as tariffs bite into foreign brands' margins. Drug prices could rise due to the industry's reliance on Chinese raw materials. Even plastic goods used in packagingcould get pricier.

Trade tensions often strengthen the dollar, which is good news for American tourists but potentially devastating for U.S. exporters trying to compete in global markets.

It's a high-stakes game of economic chicken where every move ripples through global supply chains—and in some cases, consumers pay the biggest price. Whether this aggressive approach leads to new trade, border, and drug crackdown deals—or simply deeper economic and political tensions—remains to be seen, but one thing is certain: Consumers and businesses on both sides of the Pacific are bracing for impact.

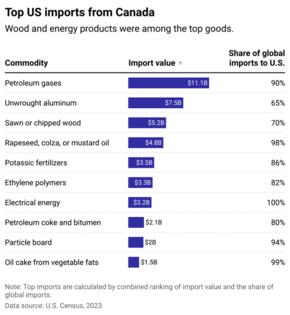

OANDA used Census data to explore how the price of top imports from the U.S.'s leading trade partners may shift due to tariffs and currency values. The top imports were calculated by ranking both the total import value in U.S. dollars, and the share of total U.S. imports of that commodity from the country as of 2023.

Visit thestacker.com for similar lists and stories.

Canada

Critical supplies like fertilizer and construction materials hang in the balance of any potential trade dispute between the U.S. and Canada. Our northern neighbor's dominance in rapeseed oil—which contributes to animal feed and biodiesel, among other uses—and fertilizer exports to the U.S. (98% and 86%, respectively) means any disruption could increase both American farmers' production costs and cut into food manufacturers' bottom lines. That potentially means higher prices at the grocery store and the gas pump. It could also cut into home heating costs for households that rely on heating oil, up to 30 cents per gallon.

Workers in U.S. manufacturing could feel the pinch if Canadian wood products and aluminum become harder to source. Consumers, already wrestling with sky-high prices and persistent inflation, could see everything from home renovation costs to certain Canadian-assembled vehicles get pricier, like the Toyota Rav4 SUV and Honda CR-Vs and Civics.

Because Canada's economy largely relies on the export of commodities, its currency is prone to fluctuations, particularly during times of volatility. The U.S. and Canadian dollars have a close relationship; aluminum and steel, two major exports from Canada to the U.S. may be impacted amid ongoing tariff uncertainty that began in early 2025.

But the possibility of tariffs remains, which could bring business activity down and encourage Canadian financial regulators to keep cutting interest rates and weaken the currency by making it less attractive to foreign investors.

China

China's grip on U.S. tech supply chains runs deep, with American companies heavily dependent on Chinese-made components for everything from smartphones ($54.6 billion in import value) and computers ($39 billion in import value) to gaming consoles (where China supplies 80% of U.S. imports).

Higher component costs and supply disruptions could force U.S. tech companies to accept lower profit margins and cut costs, including wages and jobs, as companies did during the tariff wars launched in 2018. This has a profound effect on American software developers, engineers, and manufacturing workers who designed and built these devices, costing American companies an estimated nearly $46 billion.

For consumers already struggling with high prices, trade tensions with China could mean significantly higher prices on everyday electronics like phones, laptops, and gaming systems, while the increased costs of electric vehicle batteries and automotive components could push new car prices even higher.

Even though China was the first country that Trump imposed new tariffs on in his second term, the tightly-managed yuan, with its fixed exchange rate, is actually slightly stronger than when he took office. China's targeted but limited reaction leaves open the possibility of a bigger trade deal to avoid a full-throated trade war.

Mexico

U.S. and Mexican auto industries are deeply intertwined through $32.8 billion in vehicle trade and complex supply chains that account for 75% of U.S. auto imports. A disruption in trade between the two countries could lead to job impacts and layoffs for American auto industry workers, from assembly line staff to dealership employees. It could also raise prices on vehicles imported from Mexico.

American shoppers already dealing with higher grocery bills could see even steeper prices for everyday items like tomatoes, nuts, avocados, and beer(where Mexico supplies 83% of imports), making weekly shopping trips more expensive for already stretched household budgets. Various tariff threats have sent the already volatile peso swinging this year, from declines of 2.2% to gains as high as 3.5%. If the threatened 25% tariffs do go into effect, experts say the peso could fall even further, and Mexico's economy could slide into recession.

Story editing by Alizah Salario. Additional editing by Elisa Huang. Copy editing by Tim Bruns.

This story originally appeared on OANDA and was produced and distributed in partnership with Stacker Studio.

Comments