The Trump family is going all-in on crypto projects, from bitcoin mining to stablecoins

Published in News & Features

President Donald Trump and his family have taken a interest in just about every corner of the crypto industry.

There are nonfungible tokens and digital collectibles; a decentralized finance project; a proposed stablecoin; an effort at Bitcoin mining; and a pair of memecoins, one for the president and one for first lady Melania Trump.

Taken together, the various projects are approaching $1 billion in paper gains even after accounting for the latest round of trade war-induced market gyrations, according to Bloomberg calculations based on publicly available data.

Donald Trump is already the richest person to have ever become U.S. president, and his non-crypto holdings include significant investments in real estate. After his first election in 2016, Trump’s lawyers created a trust to handle his business affairs. That was managed by his two eldest sons and by Allen Weisselberg, the longtime chief financial officer of Trump’s real estate company.

Eric Trump has emphasized that “there are no conflicts” related to the family’s crypto investments.

“I don’t work with the White House,” Eric Trump said during a Bloomberg TV interview in April. “We’ve believed in crypto for a long time.”

The president’s own public conversion to crypto is still relatively new. Trump called bitcoin a “scam” as recently as 2021, telling Fox Business at the time that he didn’t like the token “because it’s another currency competing against the dollar” and that it should be regulated “very, very high.”

Trump’s relationship with the digital asset industry has evolved significantly since then. As a candidate, he courted and benefited from significant contributions to his reelection campaign from crypto executives and advocates.

In his second term, Trump has signed executive orders in support of his promise to make the U.S. the crypto capital of the planet, installed David Sacks and Bo Hines to represent the interests of the industry, and continued to tout his memecoin with posts on Truth Social.

“Trump and his family seem eager to establish a broad foothold in the sector prior to further regulatory actions that are likely to boost cryptoasset valuations,” said Eswar Prasad, professor of trade policy at Cornell University.

Here’s how the Trump crypto portfolio has evolved.

Nonfungible tokens: December 2022

Trump became a crypto convert after falling in love with his own digital collectibles, known as nonfungible tokens.

Bill Zanker, a friend of Trump’s and the founder of adult-education company The Learning Annex, initially pitched him the idea. Since then, the Trump Trading Cards NFTs, which show him in a variety of poses and outfits (sometimes dressed as a superhero), have been spread out over four collections.

The president last year hosted dinners for fans who purchased his NFTs, which, according to financial disclosures, have brought in millions of dollars.

Decentralized finance: September 2024

The Trump family announced its crypto project World Liberty Financial ahead of the U.S. election. Since its inception, the project has been buying up millions of dollars worth of other cryptocurrencies, including Ether and Tron, though has yet to offer promised DeFi services like lending crypto without any intermediaries.

A company affiliated with Trump receives 75% of net revenue as a fee, including the proceeds of token sales, according to offering documents. The Trump family owns 60% of the equity share of the World Liberty through their company DT Marks DeFi LLC.

The company has raised $550 million in token sales after completing a second round last month.

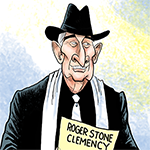

Zach Witkoff, one of World Liberty’s co-founders, is the son of Steve Witkoff, who helped connect the president’s family to other World Liberty Financial’s participants. Since the platform’s token sale in October, observers have raised questions about its potential conflicts of interest for the Trump family, given the administration’s sway over regulations.

Trump’s sons, Donald Jr., Eric, and Barron, are all listed as “Web3 Advisors” to World Liberty Financial. The family actively promotes the project through social media and public appearances.

Memecoins: January 2025

The day before Trump’s inauguration, he and his wife, Melania, launched their own memecoins, a highly speculative corner of crypto in which the asset doesn’t have much intrinsic value. After an initial surge, which likely generated more than $11.4 million in fees for entities linked to the president in January alone, prices have tanked.

The foray was met with mixed reaction from the crypto industry, as many believed it hurt the push to appear more legitimate. Two Trump-linked entities — CIC Digital and Fight Fight Fight LLC — own 80% of the supply, a holding that will be unlocked over three years.

ETFs: February 2025

Trump Media & Technology Group Corp. said in early February that it had applied to trademark brands for investment products with themes that track Trump’s priorities, including a “Truth.Fi Bitcoin Plus ETF.”

It has said it would work with Crypto.com to launch the ETF. The month before Trump’s election win, the SEC filed a notice that it intended to sue Crypto.com for operating an unregistered securities exchange. It closed its probe in March, according to the company.

Stablecoin: March 25

World Liberty Financial announced plans to launch its own dollar-tracking stablecoin called USD1, which will be initially minted on the Ethereum and Binance Smart Chain blockchains. The token will be backed one-to-one by short-term US Treasuries, dollar deposits and other cash equivalents, according to World Liberty.

The move came just ahead of landmark stablecoin legislation that advanced through the House Financial Services Committee, with crypto companies pitching stablecoins as a way to make global financial transactions cheaper and faster.

Bitcoin mining: March 31

The Trump family said it plans to launch a bitcoin mining-focused venture with Hut 8 Corp. Bitcoin miners were early supporters of Trump’s reelection campaign. In June 2024, then-candidate Trump hosted several mining executives at Mar-a-Lago, telling them he’d be an advocate for them in the White House.

The bitcoin mining sector in the U.S. has morphed into a multibillion-dollar industry.

“Investing in crypto is no longer as simple as holding bitcoin,” said Campbell Harvey, a professor of finance at Duke University. “There are many different crypto segments. Trump has a presence in lending, a future stablecoin, other cryptoassets, and now a mining operation.”

———

With assistance from Annie Massa, Kyle Kim (News), Muyao Shen and Dave Liedtka.

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments