Chicago Mayor Brandon Johnson's difficult 2025 budget fight portends even harder financial situation for 2026

Published in News & Features

One issue loomed in aldermen’s anxious speeches last week in the lead-up to a vote on Mayor Brandon Johnson’s budget for next year: 2026.

Though the mayor ultimately eked out a 27-23 win on his $17.1 billion 2025 spending plan, City Council members both for and against it warned the chaos and delays that punctuated the past few months may pale in comparison with the intractable problems waiting with the next one.

Driving their worries is the shortage of long-term solutions Johnson has provided to the structural issues in Chicago finances, concurrent fiscal crises in Chicago Public Schools and the Chicago Transit Authority, and the slim possibility for new revenue streams from the state coming through in the next year — despite the mayor repeatedly hanging his hopes on “progressive” taxes that are unlikely to materialize.

All the while, Johnson and the council will be operating under sharpening political pressure as the 2027 election gets closer and budget-balancing efforts like a property tax hike — which the mayor was counting on to plug in the 2025 fiscal gap, only to backtrack after aldermen refused to vote for it — or city workforce cuts will likely become even more controversial.

But at his news conference after the council meeting, Johnson refused to accept an alarmist view of the future. He also would not say what his Plan B would be should this progressive revenue not come through in time for the 2026 budget cycle.

“How about we just focus on what we want?” Johnson said when asked whether he’s ruled out trying to pass a future property tax hike, after aldermen threw his latest attempt back in his face.

“I want you all to stay positive, OK, because the people of Chicago and the state of Illinois really require that. Look, I know it’s easy to go back and forth about this tax versus this tax, but people have sold the people of Chicago out for too long, and they have kowtowed to the interests of the ultrarich.”

Progressive revenue

The mayor has time and again asserted the ball is in Springfield’s court when it comes to providing ways to make wealthy people pay more in order to plug the city’s next budget gap.

Johnson repeated four times Monday that his administration is working with Pritzker’s on a “regular basis” to come up with progressive revenue ideas. A source close to the governor said they were “baffled” by Johnson’s comments.

Regular, meaningful discussions between Johnson and Pritzker’s camps to find new progressive sources of money have not been occurring, the source said.

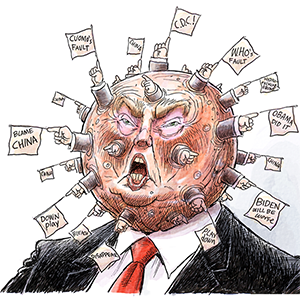

Playing political hot potato with the possibility of progressive funding from the state could be a way for the mayor to try to deflect blame if he must resort to property taxes or other deeply unpopular ways to close the city’s deficit, though voters tend to remember the officials who vote for painful increases and the governor would likely forcefully challenge any attempt to make him wear the jacket for Chicago’s financial woes.

When asked whether it is realistic to expect the state to help the city in its 2026 budget, the mayor’s budget director, Annette Guzman, said Springfield will need “big solutions” to resolve its own pending budget shortfall, and proceeds from such solutions could flow down to cities.

But Ald. Scott Waguespack, 32nd, accused the mayor of relying on an unlikely “trope” with his calls for progressive revenue.

“It’s bull—-,” said Waguespack, who is often at odds with Johnson. “I think the mayor’s approach is essentially, ‘Spend every penny we have and, down the line, it’s somebody else’s problem that they’ll have to deal with.’”

The city is in stable condition now, Johnson ally Ald. William Hall, 6th, said, “but we can easily get into intensive care.” The prognosis means Chicago must look to Springfield, as well as weigh measures like cutting more vacant jobs, he added.

“We do have to make more aggressive moves at the state level, in partnership,” Hall said. “We cannot say we want a caviar lifestyle with pork-and-beans money.”

Hall, appointed by Johnson last year to head the City Council’s new Revenue Subcommittee, which at met once in 2024, identified hemp products, video gambling and a restored grocery tax as potential new revenue streams for Chicago.

Aldermen tapped many of the most accessible budget-balancing fees, hikes and efficiencies this year, making a property tax hike a potentially more necessary tool next year. But they will be just over a year out from reelection when they pass a 2026 budget, meaning they will be even more scared of voter backlash if they resort to it.

Structural issues

Chicago has been under threat of downgrade for several weeks because of potential retreat from a key long-term pension reform and a continued lack of structural budget solutions. A downgrade isn’t only a reputational hit. It increases the city’s cost to borrow money for long-term projects like Johnson’s housing and development bond.

In mid-November, S&P put Chicago on credit watch and warned there was a 2-to-1 chance of a downgrade — not long after the city exited junk status in late 2022 — if it relied too much on short-term fixes to plug its gap.

Johnson’s spending plan for 2025 doesn’t resolve those long-standing problems, but Guzman maintained it was “a start.”

“We have to rely on structural solutions to support our ongoing expenditures,” Guzman told the Tribune. “We can’t accomplish it in one year.”

The city should not face a credit downgrade, she said, arguing structural imbalances long predate Johnson, and he has begun a gradual shift toward sustainability.

While Fitch and other financial experts argue the city did do right by preserving additional payments to keep its pension funds afloat, they have also noted the city closed a significant amount of its gap — the Johnson administration estimates about 30% — with nonstructural revenues.

That includes $132 million in surplus from tax increment financing districts and about $140 million in surplus money from past years. Tweaks to appease aldermen added more one-time budget plugs: $74 million in remaining federal pandemic American Rescue Plan Act funds and $53 million in savings the city is counting up front from its recent bond refinancing.

Michael Rinaldi, a senior director in Fitch’s public finance group, said this year’s budget “virtually guarantees” next year will be a challenge. Some of the structural fixes the city was counting on — a slew of new taxes, fees and $286 million in operational efficiencies — “warrant some degree of caution given risk to implementation,” he said.

Though Johnson frequently blamed a drop in personal property replacement tax revenues in Springfield for driving this year’s gap, some of his own decisions “certainly contributed” to it, too, according to the Civic Federation’s Joe Ferguson.

That includes a 20% raise granted to Chicago police over the term of their recent four-year contract, a legislative tweak that Johnson blessed, adding $1.06 billion to the police pension fund’s total liability, and the decision to skip last year’s inflation-tied property tax increase.

A handful of sweeteners to secure support from allies — like a $500,000 snow plowing pilot and more than $400,000 to fund a vice mayor’s office — are not huge cost drivers themselves, but “a reflection of small-bore, easily understood situations where money is being allocated and savings are not being exploited, that are symbols of a larger whole,” Ferguson said.

Sister agencies

The city’s sister agencies are due for a financial reckoning as well, one that could influence Johnson’s future budget cycles.

At CPS, Johnson has been in a monthslong power struggle with district leadership over a $175 million pension payment for nonteacher employees as well as a high-interest loan that would cover that amount plus the start of the upcoming Chicago Teachers Union contract. Though it now appears Johnson will get to install new leadership sympathetic to his stance on CPS absorbing the pension payment and taking out the loan, the high-stakes drama underscores how intertwined the city and school district’s finances are.

Meanwhile, the CTA is staring at a $730 million fiscal cliff once federal pandemic aid dries up in early 2026. A Springfield bill to consolidate the CTA with the region’s other three transit agencies, over the objections of CTA leadership, also remains pending.

Johnson and the CTU have sought to place the onus for funding CPS more on Pritzker but have been unsuccessful.

Ferguson was skeptical Springfield would come to the rescue, because the state is facing its own fiscal reckoning next year, and because Johnson’s preferred graduated income tax reform has already been shot down by voters.

Asked whether she expects the Johnson administration to once again recommend property tax hikes next year, Guzman said, “Every tool has to be available.” But, she added: “Stop reading the last page before you read the beginning.”

_____

©2024 Chicago Tribune. Visit chicagotribune.com. Distributed by Tribune Content Agency, LLC.

Comments