Need more time to file taxes in California? Here's how to get an extension

Published in Business News

Tax Day is almost here.

Tuesday, April 15, is the deadline to submit your 2024 tax documents and any payment you owe to the Internal Revenue Service and the California Franchise Tax Board.

If you aren’t ready to file, you might be eligible for a deadline extension.

Here’s how you can get more time to submit your tax paperwork:

Who is eligible for a tax filing deadline extension?

All taxpayers living in the United States can request a six-month deadline extension for filing their tax returns, according to the IRS.

U.S. taxpayers who living outside of the country on Tax Day automatically get a two-month filing extension, according to the agency’s website.

All California residents and businesses who pay state taxes are allowed to file their returns any time before Wednesday, Oct. 15 without filling out an application, according to the state tax board.

Do I still have to make a payment to IRS if I get an extension?

Yes, you still need to pay any taxes you owe to the IRS by Tuesday, April 15, according to the IRS website.

The extension only applies to filing a tax return in most cases, the website said.

The same applies for California tax extensions — the state can levy “penalties and interest” on overdue taxes if they are not paid by the deadline.

Taxpayers in certain areas classified as a disaster zone by the federal government may be able to make tax payments at a later date, according to an IRS news release.

Can I file later if I was impacted by Southern California wildfires?

Certain taxpayers who were affected by recent natural disasters, as designated by the Federal Emergency Management Agency, have get an automatic extension on their federal tax deadlines, according to an IRS news release.

Californians impacted by the Palisades, Eaton and other fires in the Los Angeles area in January can wait until Wednesday, Oct. 15, to file their tax returns and pay any outstanding taxes due, the IRS said in the release.

People who have residences or businesses in Los Angeles County will automatically be granted the six-month extension, according to a January news release from the IRS.

What if I don’t live in Los Angeles County?

California taxpayers affected by the Los Angeles County fires who don’t live or own businesses in the disaster zone can request an extension as well, the IRS said.

That includes wildfire relief aid workers who are associated with a recognized philanthropy or governmental organization, according to the IRS.

If you live outside of the FEMA-designated disaster area but believe you qualify for a postponement on your tax deadlines, you can call the IRS at 866-562-5227.

The California Franchise Tax Board is extending tax filing and payment deadlines for wildfire victims to Oct. 15, according to previous Sacramento Bee reporting.

According to the state tax agency, wildfire-affected taxpayers who are filing past the April 15 deadline should write the name of the disaster, such as “Los Angeles Fire,” at the top of their paper state tax return to notify the board of the reason they’re filing late.

If you are filing electronically, follow instructions on how to include information about the disaster, the state tax board said on its website.

How can I extend my deadline for filing taxes?

According to the IRS, there are three ways to get an extension on submitting tax filings until Wednesday, Oct. 15:

—If you owe taxes, pay through an IRS-approved online payment system by Tuesday, April 15, and select an “extension” option, indicating you are paying now but filing later.

—Request an automatic extension while filing through IRS Free File.

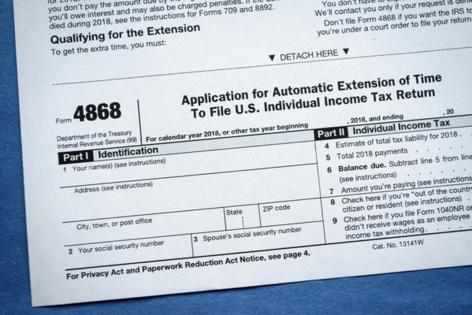

—File Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return by mail, through an e-filing option or with a tax professional.

In California, every taxpayer is automatically granted a six-month extension for sending in their tax return.

As long as you file before Wednesday, Oct. 15, you will not be subject to a late filing penalty, according to the state tax board.

©2025 The Sacramento Bee. Visit at sacbee.com. Distributed by Tribune Content Agency, LLC.

Comments