Ford sales drop ahead of potential tariffs on Canada, Mexico

Published in Business News

Ford Motor Co. on Monday said U.S. sales in February fell 8.9% year-over-year as it sees lower rental demand from a year ago, unloads older product and its largest plant in Kentucky is retooled for the next-generation Ford Expedition and Lincoln Navigator.

The report from the Dearborn automaker comes as analysts expected the auto industry's February U.S. sales would recover from a slower January and send the seasonally adjusted annual rate of vehicles sales between 16.1 million and 16.3 million. It also comes on the eve of a deadline to place 25% tariffs on goods from Canada and Mexico if a deal is unable to be reached between the neighboring nations and the Trump administration — an event Ford CEO Jim Farley has said would "blow a hole in the U.S. industry that we have never seen."

“Though we are still optimistic about market growth in 2025," Charlie Chesbrough, senior economist at vehicle information services firm Cox Automotive Inc., said in a statement, "policy changes regarding tariffs and battery electric vehicle credits by the new Trump administration could have significant negative effects on the current outlook.”

Ford's February results reflect lower demand from daily rental companies compared to the higher sales rates a year ago, said Erich Merkle, Ford sales analyst.

"Automakers have a daily rental channel that they sell to that is volatile from month to month depending on the timing on the orders," he said. "We do expect that to increase this year as we get into the second quarter, because the daily rental in the second quarter was lower last year."

Ford started 2024 with a higher percentage of models on dealer lots at the start of the year compared to competitors as well as the discontinuation of the Edge crossover. To retool for new models, Ford also paused production of its popular Super Duty trucks and full-size SUVs at its Kentucky Truck Assembly plant. The company said in 2023, when the United Auto Workers struck the plant, that it generated about $25 billion a year — a seventh of Ford's global revenues that year.

Expedition sales fell 48%, and the Navigator was down 17%. Its key profit-driving F-Series trucks, however, were up 14%, including a 7% increase in Super Dutys. That contributed to a best February and year-start for Ford pickups since 2004 as demand remains robust from commercial and retail customers, Merkle said.

Ford's all-electric vehicle sales rose 15%, and hybrids increased 28% for a best-ever start to the year for electrification and a record February. But models with internal combustion engines, which represented 86% of deliveries, fell 13%. SUVs were down 24%, trucks rose 7.7% and the Mustang coupe was down 32%.

Despite refreshes last year, Bronco Sport sales fell 6.3%, Explorer declined by 23% and Maverick dropped 23%. Escape rose 5.5%, and Bronco was up 20%. The electric Mustang Mach-E rose 13%. Ford is covering the cost of a Level 2 home EV charger and its standard installation through the end of the month for EV buyers.

"It's been very successful for us," Merkle said about the Ford Power Promise program. "It's one of those obstacles. 'Where do I get it charged and how do I do this?' It's an objection a consumer might have. We've taken that away from them. We'll come in and install it at no cost. That really helps consumers make that choice to say, 'Yeah, an EV might work for me.'"

Still, F-150 Lightning truck deliveries were down 15%, while the hybrid F-150 was up 32%. Sales of the E-Transit commercial van more than doubled as a part of the 3.5% increase overall in Transit vans, marking a record February. Ranger midsize truck sales totaled 4,448 after selling none last year from inventory depleted by the UAW's 2023 strike and the launch of an updated model.

Lincoln sales fell 21% with all models down: 3.2% for the Corsair, 27% for the Nautilus and 30% for the Aviator.

Ford builds several models in Mexico, including Maverick, Mach-E and Bronco Sport. Ford builds engines in both Canada and Mexico and has an electric powertrain center in Mexico. It's also expanding production starting next year of Super Dutys to its idled Oakville Assembly Complex in Ontario.

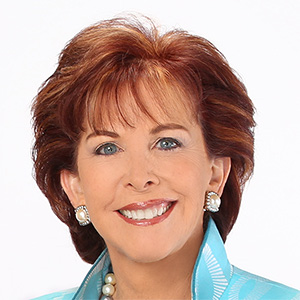

Farley last month on an earnings call said Ford's wholesales are down 20% quarter over quarter, and the goal in the first half of the year is to get days of supply to below 60 days. Half of the company 's first-quarter sales are expected to be 2025 models, Chief Financial Officer Sherry House said.

"We'll be in good shape after the first quarter," Farley said, adding about inventory: "It actually gets leaner after the second quarter."

General Motors Co. and Stellantis NV will report first-quarter U.S. sales next month. Subaru Corp. on Monday said its February sales rose 4.1%, Hyundai Motor Co. achieved a record February sales month with a 3% increase and Kia Corp.'s were up 7.2%.

©2025 www.detroitnews.com. Visit at detroitnews.com. Distributed by Tribune Content Agency, LLC.

Comments