Trump tariffs would harm major US auto buyer, GM Canada chief says

Published in Business News

Donald Trump’s tariff threats stand to hurt American economic interests because they would disturb automotive supply chains where the U.S. is strong and drive up consumer prices, said the head of General Motors Co.’s Canadian unit.

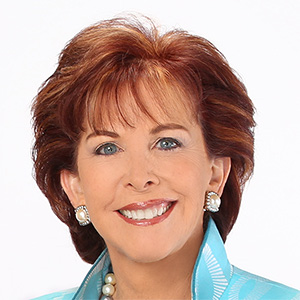

“It is a disruption that is in no one’s interest, especially in the U.S.,” GM Canada President Kristian Aquilina said in an interview.

Trump has threatened 25% tariffs on goods from Canada and Mexico, in addition to other trade measures. A report in the Wall Street Journal on Monday said the incoming president will stop short of imposing tariffs on his first day in office. Instead, the new administration will direct federal agencies to evaluate U.S. trade relationships with China, Canada and Mexico, the Journal reported.

Canadian officials have said they’re waiting for Trump’s decision on tariffs, but they will retaliate if necessary with counter-tariffs against U.S. products. If those are applied to cars and trucks, it would make U.S.-manufactured vehicles less attractive to buy.

That would be a blow to Canadian consumers, who are significant buyers of U.S.-made cars and trucks. About 50% of the vehicles sold in Canada by value in 2023 were imported from the U.S., according to calculations by the Trillium Network for Advanced Manufacturing, a research group based in the province of Ontario.

The U.S. is also the dominant outside supplier of parts, providing about 65% of Canada’s auto-part imports, Trillium said. Mexico has a 14% share.

Overall, Canada had about a C$40 billion ($27.7 billion) trade deficit on motor vehicles and parts in 2023, according to data from Statistics Canada. It’s the largest single category of Canadian imports from the U.S.

North American auto supply chains may have to change depending on how far Trump goes with tariffs, Aquilina said. “We are going to size that up, whether it’s January 21 or later, and work out the best response, and what adjustments we need to make in our business,” said the executive, adding that too many unknowns remain for now.

Detroit-based General Motors makes a limited number of vehicle models in Canada. Its two Ontario assembly plants build Chevrolet Silverado pickup trucks and electric vans for commercial use. Another GM plant in the province manufactures engines and transmissions for U.S. factories that make full-size trucks and the Chevrolet Corvette.

Tariffs, if there are no exemptions, will simply end up increasing the cost of vehicles and components traded back and forth among countries, Aquilina said. “It’s an industry that’s been built over a long period of time to assume natural flow of goods.”

Tariffs might also put additional pressure on the Canadian dollar, making it even more expensive to import U.S. parts to build vehicles in Canada, he said. The loonie slumped about 4.5% between U.S. election day and Jan. 17.

That currency weakness is already being felt in the sector, the GM executive added. “The cost of those vehicles for us to purchase, and then sell to our dealers and customers, is getting higher.”

That’s not the only headwind for sales. Canadian governments are phasing out or pausing incentives on electric vehicles, despite a federal policy mandating that by 2035, all new light-duty vehicles sold should be zero-emission. An interim target of 20% has been set for next year.

For GM, Canada is the company’s third-largest market, representing 294,000 vehicles sold last year, about 14% of which were electric. The company has about 8,000 employees in Canada.

Aquilina said Canada should back off the 20% target for 2026 because it’s “unrealistic,” and price reductions to stimulate electric-vehicle purchases aren’t sustainable. “We’re hurting ourselves, and making us weaker in response.” GM’s adjusted profit margin was 6.3% in the 12-month period ended Sept. 30, according to data compiled by Bloomberg.

©2025 Bloomberg L.P. Visit bloomberg.com. Distributed by Tribune Content Agency, LLC.

Comments