Luigi Mangione murder case draws scrutiny of health claim denial rates

Published in Business News

Three of Maryland’s top health insurers have higher than average claim denial rates, according to research that’s gained traction in the wake of the fatal shooting of UnitedHealthcare CEO Brian Thompson and the arrest of suspect and Baltimore area native Luigi Nicholas Mangione.

UnitedHealthcare, Maryland’s third-largest health insurer by market share, ranked first in failure to pay, denying about one-third, or 32%, of claims in 2022, said an analysis by consumer research site ValuePenguin, a subsidiary of LendingTree.

The report showed two of Maryland’s other top six insurers also had denial rates above the national average of 16%. They include BlueCross BlueShield, which operates in Maryland as CareFirst BlueCross BlueShield, with a 17% denial rate, and Cigna Health Group, with an 18% rate.

“The health insurance company you have can affect how likely it is your medical claim will be denied,” said a ValuePenguin post that appeared in May, months before UnitedHealthcare’s Thompson was killed on Dec. 4 in New York City. “For example, UnitedHealthcare denies about a third of in-network claims.”

UnitedHealthcare disputed claim rates it says have been circulating, though the company declined Monday to comment specifically on ValuePenguin’s figures. Representatives of CareFirst and Cigna did not respond to requests for comment Monday.

A Dec. 6 update on ValuePenguin’s research said the site removed “certain data elements” from the post “at the request of law enforcement.”

The suspect in Thompson’s death, Mangione, a Gilman graduate, faces five charges in New York, the most serious being second-degree murder, which in New York is roughly the same as Maryland’s first degree murder statute.

It was unclear which data elements were removed, but it appeared the most recent version of the post no longer includes a bar graph ranking companies’ rates of claim denial. The rates corresponding to the chart remain, however. ValuePenguin also had said in a Dec. 5 update that “one insurer contacted ValuePenguin claiming that the denial rate listed in this article is not consistent with their internal records.”

Lending Tree, ValuePenguin’s parent company, did not respond to questions about data removal or whether it was connected to the insurer that disputed its rate.

UnitedHealthcare said in a statement that it pays about 90% of medical claims upon submission and that only one-half of one percent of claims that need further review are flagged for medical or clinical reasons.

About half of claims not initially paid have administrative errors and can be corrected, while most of those remaining have issues such as lack of coverage with UnitedHealthcare or are duplicate submissions, the statement said.

“Any other numbers being discussed in some quarters purporting to be the UnitedHealthcare approval rate are wrong,” the statement said. “Highly inaccurate and grossly misleading information has been circulated about our company’s treatment of insurance claims.”

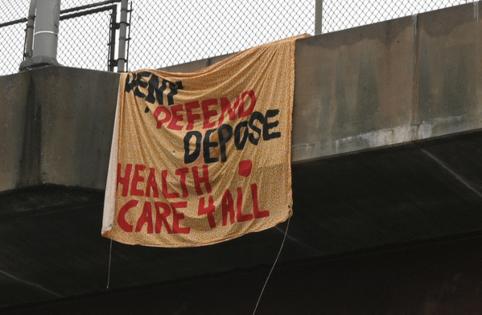

Charts showing rankings of insurance claim denials by company have been circulated on social media on sites such as Tumblr, X (formerly Twitter) and rReddit, part of a public outcry about unfairness in the health insurance industry.

UnitedHealth Group, parent of UnitedHealthcare, has a nearly 17% share of the market in Maryland, while Carefirst Inc. has a nearly 34% share and Cigna has a 5% share, according to the National Association of Insurance Commissioners. Kaiser Permanente, which the ValuePenguin report said had the lowest claim denial rate of all insurers at 7%, has a more than 17% share of Maryland’s market.

ValuePenguin said it based its claim denial rates on publicly available denial and appeals data from the Centers for Medicare & Medicaid Services. The denial rates look at in-network claims, the analysis said.

The consumer site said it downloaded public-use files containing the data on March 1, covering data from Jan. 1, 2022 through Dec. 31, 2022. It presented the most current data when the article was published in May.

The analysis also showed top reasons for claim denials, based on Experian’s Report of the State of Claims. Claims are denied at a rate of 48% because procedures lacked prior authorization, 42% because doctors or hospitals were out of network and 42% because of billing code issues, the analysis said.

©2024 The Baltimore Sun. Visit at baltimoresun.com. Distributed by Tribune Content Agency, LLC.

Comments