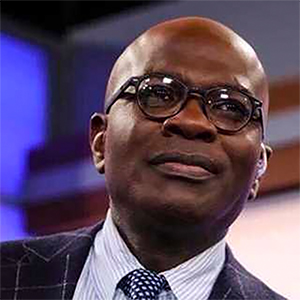

Hedge fund manager Scott Bessent gets Trump blessing for Treasury

Published in Political News

WASHINGTON — President-elect Donald Trump said Friday he would nominate hedge fund manager Scott Bessent to be Treasury secretary in his second term, a critical role in tax policy, global finance and managing the U.S. debt load.

To become the presumptive nominee, the founder of Key Square Group overcame scrutiny from the right over ties early in his career to Democratic megadonor George Soros and a play for the job by Howard Lutnick, CEO and chairman of Cantor Fitzgerald and co-chair of Trump’s transition team. Lutnick ended up with the nod for Commerce secretary with an expanded role in trade policy as a consolation prize.

“Scott is widely respected as one of the world’s foremost International Investors and Geopolitical and Economic Strategists,” Trump wrote on Truth Social, his social media platform. “Scott has long been a strong advocate of the America First Agenda.”

Bessent emerged as a favorite early on, but an initially unconvinced Trump widened his slate of candidates to include Apollo Global Management CEO Marc Rowan, Sen. Bill Hagerty, R-Tenn., and Kevin Warsh, a former member of the Federal Reserve Board of Governors and a top economic official in the George W. Bush administration.

Tesla founder Elon Musk, a top Trump ally who has the president-elect’s ear, also expressed opposition to Bessent, at least at first.

He posted on X, the social media platform he owns, that Bessent would be a “business-as-usual choice” and that Lutnick was the better option. “Business-as-usual is driving America bankrupt, so we need change one way or another,” Musk wrote.

The soon-to-be nominee has pushed economic views largely in line with the president-elect’s, but has downplayed campaign talk of broad tariffs as negotiating tactics. Days after the election, he authored a Wall Street Journal op-ed trumpeting the positive market reaction to Trump’s victory, calling it “a vote of confidence in U.S. leadership internationally and in the dollar as the world’s reserve currency.”

Bessent, who jumped on the Trump train back in 2016, donated at least $1 million in support of Trump during the 2024 campaign cycle, according to OpenSecrets.org. He also co-hosted a pair of lucrative fundraisers for Trump this year, reportedly raking in nearly $60 million.

The South Carolina native has spent his career on Wall Street, rising to chief investment office at Soros Fund Management before starting his own firm in 2015 with a $2 billion anchor investment from Soros. His ties to Soros, a liberal donor and often a boogeyman to the right, fueled a last-ditch effort by conservatives to replace him with Lutnick as the intended Treasury nominee.

While Bessent has largely toed the party line on Trump’s economic policy platform, he has downplayed the president-elect’s plan to impose blanket tariffs of 10% or 20% on imported goods.

“Given Donald Trump’s credibility and what he has done in the past on tariffs, that we may not have to get to tariffs,” he said at a Manhattan Institute event in June. “But the threat of tariffs will change the quality and the fairness of a lot of historically poor trade deals.”

In keeping with Republican leadership, Bessent has pushed for deregulation, ramping up domestic energy production and curbing deficits.

“We’re at the Last Chance Bar and Grill to grow our way out of this,” Bessent said of the debt in June.

He pushed for extending and paying for the expiring 2017 tax provisions. There are ideological differences within the Republican Party about how much tax cuts ought to be offset. Bessent’s confirmation would add a powerful voice to the pay-for camp.

Offsets should include rolling back the 2022 budget and climate law, making changes but not cuts to Medicaid, and freezing discretionary spending outside of defense, he said.

Bessent added that Treasury should also lengthen the maturity of U.S. debt. Conservatives had criticized Treasury Secretary Janet L. Yellen for relying too heavily on short-term Treasury bills to finance the debt, rather than locking in fixed interest rates for longer period.

“I think that there is a chance you could get into a good reflexive cycle on debt cost, because I think it’s been imprudent to finance at the front end,” Bessent said.

Eventually, Congress should curb mandatory spending on entitlement programs, Bessent said. But that’s a problem for another administration.

“These entitlements are massive. I think that the next four years isn’t the time to deal with them,” he said at the June talk. “I always say, crawl, walk, run. We got to crawl and maybe walk our way to get the current deficits under control. Then the next step is for (a) future administration to have the confidence to deal with the entitlements.”

In a statement Friday, top Senate Finance Democrat Ron Wyden said that during confirmation hearings he would be asking Bessent tough questions about Trump’s proposals to pay for next year’s tax cut bill with tariffs.

“The next Treasury secretary is going to have his hands all over that process, and I’m going to have a lot of questions for Mr. Bessent about the merit of a Trump policy that will intentionally inflict economic pain on families who are already getting clobbered by the cost of living,” Wyden, D-Ore., said.

©2024 CQ-Roll Call, Inc., All Rights Reserved. Visit cqrollcall.com. Distributed by Tribune Content Agency, LLC.

Comments